Fed model reconsidered

The Fed model for equity valuation compares the E/P of stocks to the 10yr yield on Treasurys. The usual justification is that stocks and bonds are competing asset classes, and one should compare their future cash flows to obtain a relative valuation. When yields on bonds are low, investors will tolerate a lower E/P (or higher P/E) in equities. One subtlety here is future inflation, which seems to "pass through" to corporate earnings, but erodes the real returns on bonds. While E/P might be a plausible forecast of future real corporate cashflows, the 10yr yield is only in nominal dollars. Perhaps it would be better to substitute the 10yr yield on TIPS for the bond component.

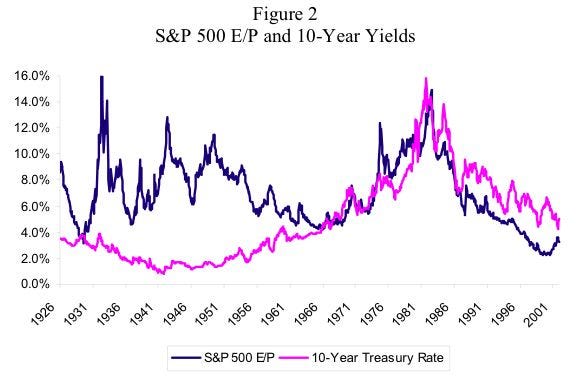

I found some interesting analysis of the Fed model (and the following figures) in this paper by C. Asness. Figure 2 shows that the Fed model has been quite successful over the last 30 years, but not for earlier periods. I had always thought this discrepancy was explained by inflation - the Fed model was successful in the recent period when inflation was perceived to be under control (i.e., post Volcker). Asness has a different take. He fits E/P = a + bY + c v_s / v_b where Y is the bond yield, v_s the trailing 20y stock volatility and v_b the trailing 20y bond volatility, reasoning that the relative perceived vols will affect the attractiveness of stocks vs bonds. The result, shown in Figure 4, is quite nice. The best fit value of b is close to 1 (similar to the Fed model), and since the trailing 20y vol is by definition slowly varying, it seems the Fed model is not a bad rule of thumb for current valuation.